Ivane Javakhishvili Tbilisi State University

Paata Gugushvili Institute of Economics International Scientific

REFORM OF DECENTRALIZATION IN UKRAINE: IMPACT ON LOCAL BUDGET INCOME

Annotation. The analysis of the effectiveness of budgetary policy implementation by local councils in the context of reform implementation in Ukraine. The tendencies of changes in the formation of revenue and expenditure of local budgets in terms of financial decentralization have been determined. The main sources of revenues and state transfers to local budgets are identified.

Keywords: decentralization, budget policy, local budget, territorial communities.

One of the key conditions for a functioning democratic society is transparency of the budget and budgetary policy. According to the Ukraine 2020 Sustainable Development Strategy, the priority in the budget process should be to increase transparency and efficiency in the allocation and spending of the country's budget. [1]. Due to the changes in the budget legislation of Ukraine, in order to achieve European standards, it is necessary to analyze international practices of implementing transparent budgetary policy and to search for new methodological directions of forming the budgetary policy of the country among scientific works. However, the study of the peculiarities of budgetary policy implementation in the initial stages of decentralization in accordance with the country's sustainable development strategy remains relevant in the context of reforms in Ukraine.

Forming financial support for local budgets is an important component of Ukraine's decentralization development. Since January 1, 2015, 60% of the personal income tax will be credited to the local budget revenues, according to Article 69 of the Budget Code of Ukraine [2]. It should be noted that before the amendments to the Budget Code of Ukraine, the corresponding tax was credited in the amount of 25%. This has become a major factor in increasing the interest of local governments in increasing local budget revenues, implementing measures to attract reserves to fill them, and improving the efficiency of administering taxes and fees. In addition to this basic tax, local budgets include: 25% environmental tax; 5% excise duty on sales of excisable goods; 100% single tax; 100% tax on profit of enterprises and financial institutions of communal property; 100% property tax (real estate, land and transportation), fees and other payments in accordance with the Budget Code of Ukraine.

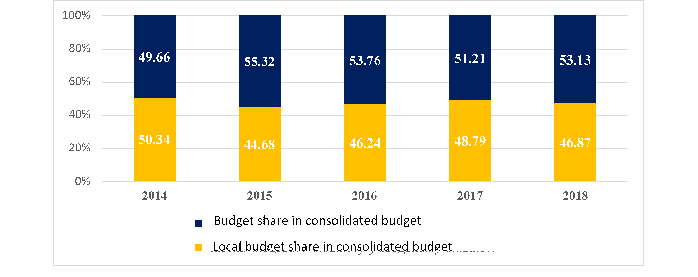

Since 2014, there has been a gradual increase in the share of local budgets in the consolidated budget from 23.8% in 2013 to 46.9% in 2018, which directly indicates the strengthening of the financial base of local governments and is, in our opinion, direct as a result of the implementation of the Concept of Local Government Reform and Territorial Organization of Government in Ukraine, adopted on April 1, 2014. (Fig. 1.)

Fig.1. - Dynamics of the share of local budgets in the State Budget since the beginning of reform in Ukraine

Fig.1. - Dynamics of the share of local budgets in the State Budget since the beginning of reform in Ukraine

Local budgets should be sufficient to ensure that local governments exercise their powers and to provide the population with services no lower than the minimum social needs, as defined in Article 66 of the Law of Ukraine "On Local Self-Government in Ukraine". [3]

Much attention is paid to issues and problems related to the formation of the local budget revenue and the implementation of reserves to fill it.

Studies of the actual revenues of the general fund of local budgets of Ukraine during 2015-2018 showed a significant increase in the total volume of their revenues. (Table 1.)

Table 1. - Dynamics of Indicators of General Fund of Local Budgetsfor 2015-2018

|

Indicators |

2015 |

2016 |

Growth |

2017 |

Growth |

2018 |

Growth |

|

Revenues of the general fund of local budgets, billion UAH. including: |

99,8 |

146,6 |

46,9% |

191,9 |

30,9% |

233,9 |

21,90% |

|

Income Tax |

53,6 |

79,0 |

47,3% |

110,0 |

39,2% |

138,1 |

25,51% |

|

Payment for Land |

14,5 |

23,3 |

61,1% |

26,4 |

13,3% |

27,3 |

3,48% |

|

Real Estate Tax |

0,7 |

1,4 |

90,0% |

2,4 |

71,4% |

4,8 |

100,88% |

|

Excise Tax |

7,7 |

11,6 |

51,2% |

13,1 |

12,9% |

13,8 |

5,32% |

|

Intergovernmental transfers, UAH billion |

174,2 |

196,0 |

12,5% |

272,9 |

39,2% |

285,5 |

4,61% |

|

in particular, basic grant, UAH billion. |

5,3 |

4,7 |

-10,7% |

5,8 |

23,4% |

8,2 |

41,07% |

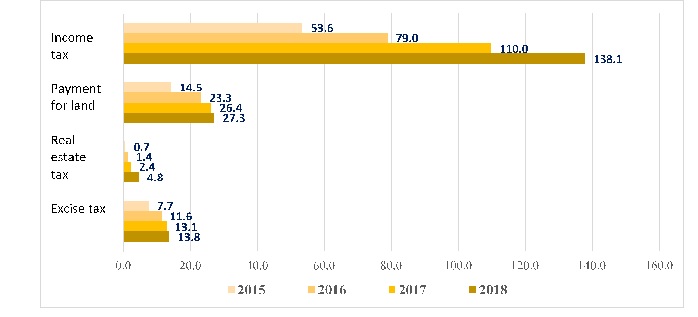

By 2014, the increase was an average of 4%. Since the beginning of the reform, the situation has changed dramatically: the amount of revenues to the general fund of local budgets in 2016 amounted to UAH 146.6 billion, which is by 47.3% more than in 2015. The growth of the main types of revenues of the general fund of the local budget, especially the personal income tax, is shown in Fig 2.

Fig.2. - Structure of Revenues of the General Fund of Local Budgets for 2015-2018, billion UAH.

Fig.2. - Structure of Revenues of the General Fund of Local Budgets for 2015-2018, billion UAH.

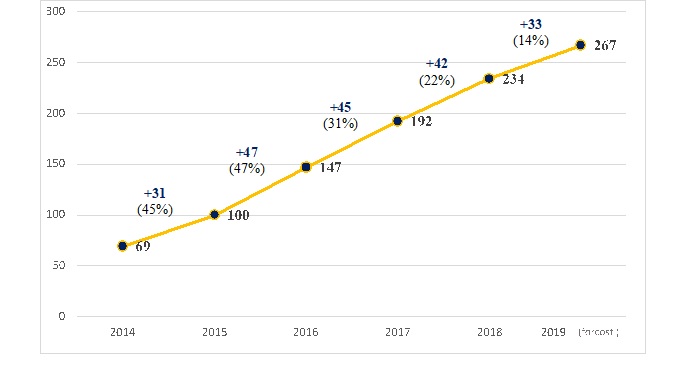

To provide a clearer idea, we will create a schedule of changes in the revenues of the general fund of local budgets since the beginning of the reform (data for 2014 are taken from the annual report of the Ministry of Finance of Ukraine (MFU) and to date according to the forecast of the MFU). (Fig. 3.)

Fig. 3. - Own revenues of the General Fund of Local Budgets, billion UAH.

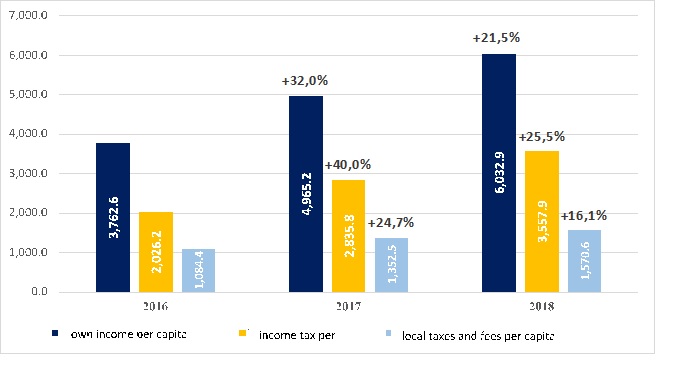

According to the results of 2018, the general fund's own income per capita increased by 21.5% compared to 2017 and amounted to UAH 6 032,9, the amount of personal income tax revenue per capita increased by 25.5% and amounted to UAH 3,557.9, local taxes and fees per capita increased by 16.1% and amounted to UAH 1,570.6. (Fig. 4.)

It should be noted that the city's PIT score per capita affects the amount of reverse subsidy from the local council. A more detailed calculation of the reverse subsidy on the example of the Mariupol City Council is made in the next paragraph of this section.

Also, convincing factors of the effective impact of financial decentralization on local government budgets in Ukraine are the decrease in the number and volume of loans granted by the State Treasury to cover temporary cash gaps (from UAH 28.1 billion in 2014 to UAH 0.1 billion in 2017), indicating that local budgets have increased solvency since the adoption of local government reform.

Based on the Concept of Local Self-Government Reform and Territorial Organization, the Government's Program of Activities, the 2020 Strategy of the President of Ukraine and the corresponding plan for their implementation, the Law of Ukraine "On Voluntary Association of Territorial Communities" [4] and the Methodology of Forming Able Territorial Communities, approved by a resolution of the Cabinet of Ministers of Ukraine in April 2015, [5] local authorities were given the opportunity to develop and approve in the regions perspective plans for the formation of capable territorial communities and submit them to the Government for approval.

Fig. 4. - Own revenues of the general fund of local budgets for 1 inhabitant for 2016-2018 years, % and UAH

However, it should be noted that there is a significant increase in state support for community development and infrastructure development, which is another positive consequence of budgetary decentralization and, directly, a step from “eating” budgets to development budgets.

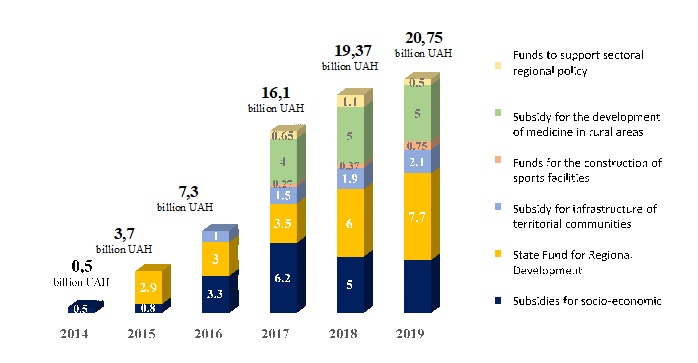

Thus, if in 2014 only UAH 0.5 billion was allocated to the regions from the state budget to support socio-economic development, then in 2018 the amount of funds for the implementation of infrastructure projects amounted to UAH 19.37 billion, and in 2019 UAH 20.75 billion is foreseen, which is 41.5 times more than in 2014.

In addition, a subsidy for construction, reconstruction, repair and maintenance of public roads of local importance in the amount of UAH 14.7 billion is foreseen for 2019. (Fig. 2.5.) [6]

It should be noted that the budget execution indicators reflect the general socio-economic status of the territory concerned and its potential for further development. The availability of sufficient resources in local budgets is an indicator that the territorial community is able to provide better and more diverse services to its residents, implement social and infrastructure projects, create conditions for business development and attract investment, develop local development programs and finance other comprehensive activities improving the living conditions of community residents [7].

Decentralization reform contributes to the qualitative improvement of the living conditions of the residents of the communities, the creation of real conditions for the comprehensive development of territories and human resources, the formation of the principles of effective local self-government [8].

In addition to finance, communities were given additional powers - external borrowing, self-selection of local budget development agencies and developmental budget revenues. Communities have also been given authority in the field of architectural and construction control and improvement of town planning legislation. From now on, local self-governments can determine their urban planning policies.

Fig. 2.5. - Dynamics of state support from 2014 to 2019, billion UAH.

Thus, studies of the impact of budgetary decentralization on Ukraine's local budgets have shown significant positive developments in the country's local government system. In addition, as a result of the reform, municipalities have become more independent and self-sufficient, and they have significant funds (by increasing their own revenues) that they can use without undue guidance from the center for the needs and development of the community, which, is one of the significant benefits of financial decentralization.

References

- Про стратегію сталого розвитку «Україна – 2020» [Електронний ресурс]: Указ Президента Україні від 12.01.2015 №5/2015: https://zakon.rada.gov.ua/laws/show/5/2015

- Бюджетний кодекс України від 08.07.2010 № 2456-VI [Електронний ресурс]: https://zakon.rada.gov.ua/laws/show/2456-17

- Закон України від 21.05.1997 № 280/97-ВР «Про місцеве самоврядування в Україні» URL: https://zakon.rada.gov.ua/laws/show/280/97-%D0%B2%D1%80

- «Про добровільне об’єднання територіальних громад» [Електронний ресурс]: Закон Україні від 05.02.2015 № 157-VIII: https://zakon.rada.gov.ua/laws/show/157-19

- Постанова КМУ від 0.04.2016 №214 «Про затвердження Методики формування спроможних територіальних громад» [Електронний ресурс]: https://zakon.rada.gov.ua/laws/show/214-2015-%D0%BF

- Децентралізація в Україні [Електронний ресурс]: https://decentralization.gov.ua/

- Чечель А.О., Аршакян А.А. Особливості реалізації прозорої бюджетної політики в рамках децентралізації в Україні. Збірник наукових праць Донецького державного університету управління «Сучасні проблеми державного управління в умовах системних змін». Серія «Державне управління». Т. ХІХ, вип.307. – Маріуполь. ДонДУУ, 2018. – 164 с.

- Децентралізація влади: порядок денний на середньострокову перспективу: аналіт. доп. / [Жаліло Я. А., Шевченко О. В., Романова В. В. та ін.] ; за наук. ред. Я. А. Жаліла. – Київ: НІСД, 2019. – 192 с.